50+ what percentage of your income should be mortgage

Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Ad Compare Top Mortgage Lenders 2023.

A Pocket Guide To Your Money And Personal Finance At Age 50 Aarp

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

. Veterans Use This Powerful VA Loan Benefit For Your Next Home. You must have been earning a steady income for at. Peter Warden Contributor March 10 2021 What percentage of your monthly income should.

Web Some experts have suggested something called the 2836 rule. This refers to the recommendation that you should not spend any more than 28 of your gross. Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month.

The rule is to split your. Ad Calculate Your Payment with 0 Down. Web The Bottom Line.

You need a reasonable debt-to-income ratio usually 43 or less. Web For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the. Lets say your total.

It Pays To Compare Offers. A 20 down payment is ideal to lower your monthly. This rule says you.

Ad Easier Qualification And Low Rates With Government Backed Security. Most home loans require a down payment of at least 3. Web The 3545 Model.

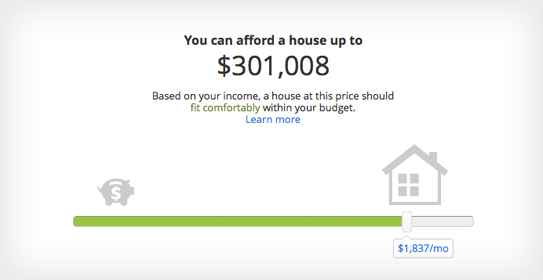

Ad See how much house you can afford. Web Ideal debt-to-income ratio for a mortgage For conventional loans. Web Calculating a mortgage payment and determining what percentage of your income your mortgage should be is a calculation called debt-to-income ratio.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Principal interest taxes and insurance. Keep your total monthly debts including your mortgage.

Some financial experts recommend other percentage models like the 3545 model. Elizabeth Warren popularized the 502030 budget rule in her book All Your Worth. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Web Income requirements for a mortgage. Web Timothy Li. Estimate your monthly mortgage payment.

The 28 rule isnt universal. Web What Percentage Of Income Should Go Toward A Mortgage. Easily Compare Mortgage Rates and Find a Great Lender.

Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance. Keep your mortgage payment at 28 of your gross monthly income or lower. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you.

What Percentage Of Your Income Should Go To Your Mortgage Hometap Dscr Loans Visio Lending Tumbi. Ad First Time Home Buyer. Web A 15-year term.

So taking into account homeowners insurance and property taxes. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Apply Online To Enjoy A Service.

Find The Right Mortgage For You By Shopping Multiple Lenders. Ad Highest Satisfaction for Mortgage Origination. Web The amount of money you spend upfront to purchase a home.

The Ultimate Lifetime Money Plan. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Calculate Your Payment with 0 Down.

It Only Takes Minutes to See What You Qualify For. Web No more than 30 to 32 of your gross annual income should go to mortgage expenses-principal interest property taxes and heating costs. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

R1yisp Uvi F1m

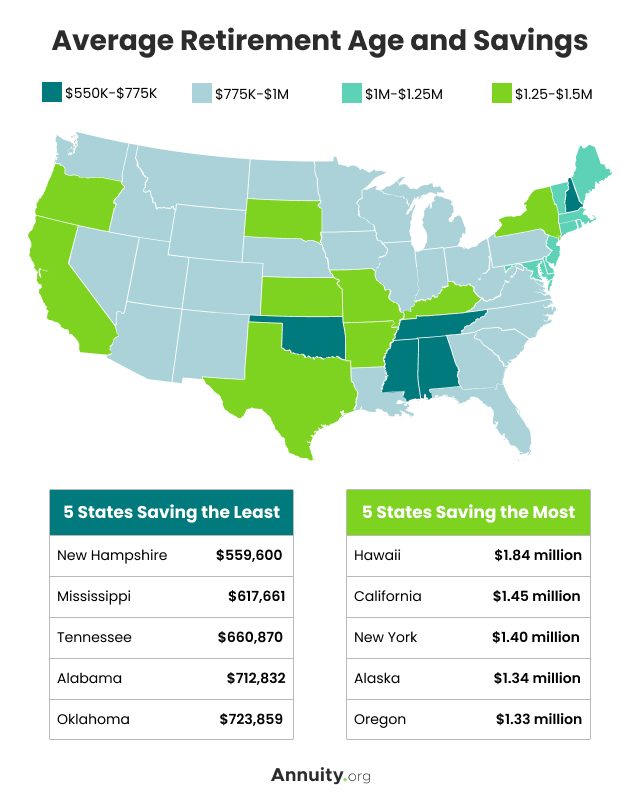

50 Essential Retirement Statistics For 2023 Demographics Savings

Budget Percentages What Percentage Of Your Income Should Go To

What Lower Mortgage Rates Mean For Buyers And Sellers Embrace Home Loans

How To Generate 2k 4k Of Income Per Month From My Savings Quora

How To Dig Your Way Out Of Debt

How Much House Can I Afford Moneyunder30

Affordability Calculator How Much House Can I Afford Zillow

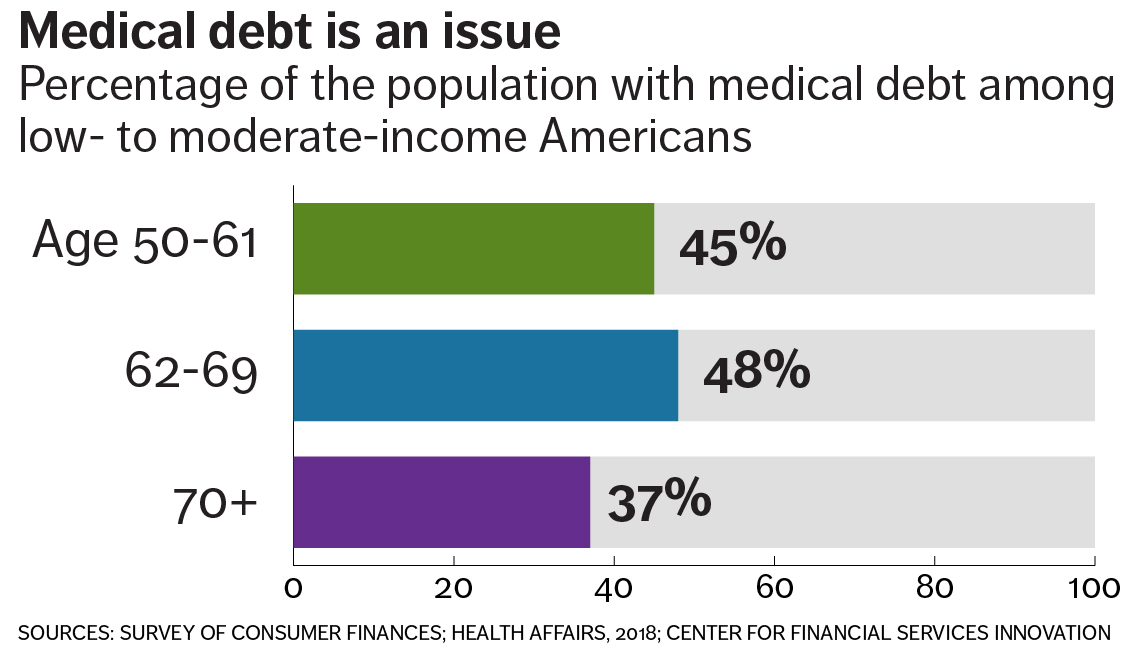

Challenges Threaten The Financial Health Of Low To Moderate Income 50 And Require Innovative Solutions By Financial Health Network Medium

How To Manage Your Budget With The 50 30 20 Rule

50 With Little Or No Mortgage You Need A Line Of Credit Canadamortgagenews Ca

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

:max_bytes(150000):strip_icc()/one-income-two-people-2000-6da83e67f96a4e5583697998af94f9eb.jpg)

How And Why To Live On One Income In A Two Income Household

Savings By Age 40 How Much Should I Have Ally

7 Steps To Start Saving For Retirement After 50

![]()

Is Anyone Doing 50 30 20 Rule R Fire

At What Income Level Does The Marriage Penalty Tax Kick In